Masbate Mine – The Philippines (1)

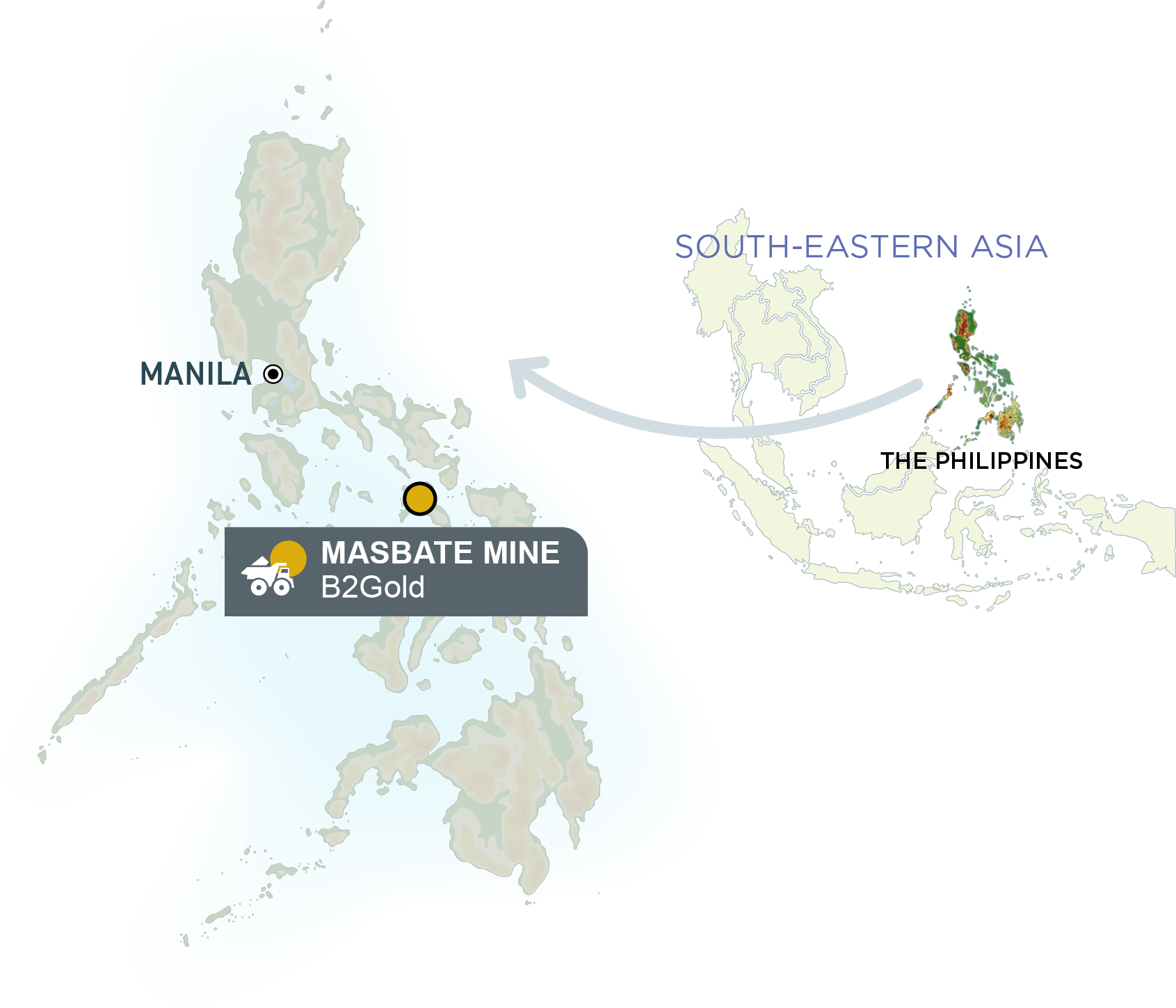

The Masbate Gold Project is located on Masbate Island in the Philippines. The Masbate Mine is located approximately 360 km southeast of the country's capital, Manila.

Click here for mine/project location map.

B2Gold acquired its interest in Masbate through its acquisition of CGA Mining Limited in January 2013.

The Masbate Mine is expected to produce between 170,000 and 190,000 ounces of gold in 2024 at cash operating costs of between $945 and $1,005 per ounce and all-in sustaining costs of between $1,300 and $1,360 per ounce. Gold production is scheduled to be relatively consistent throughout 2024. For 2024, Masbate is expected to process 7.9 million tonnes of ore at an average grade of 0.93 g/t with a process gold recovery of 76.0%. Mill feed will be a blend of mined fresh ore and low-grade ore stockpiles.

Capital expenditures for 2024 at Masbate are expected to total $49 million, of which approximately $33 million is classified as sustaining capital expenditures and $16 million is classified as non-sustaining capital expenditures. Sustaining capital expenditures are anticipated to include $16 million for mining and mobile equipment replacement and rebuilds, $6 million for deferred stripping, $6 million for process plant, and $3 million for tailings storage facility expansion. Non-sustaining capital expenditures are anticipated to include $16 million for land acquisition and development.

Click here for Masbate Mine overview.

Mine Snapshot:

2023:

- Gold production(3): 193,502 oz

- Cash operating costs(2) : $859 /oz produced

- AISC(2): $1,143 /oz sold

2024 Guidance:

- Gold production: 170 Koz - 190 Koz

- Cash operating costs: $945 - $1,005 /oz

- AISC: $1,300 - $1,360 /oz

Click here for B2Gold’s Q4 and Full Year 2023 Earnings news release (dated February 21, 2024)

Mine/Project Location Map:

Mine Overview (as at December 31, 2023):

| 2023 Production, Costs, Revenue & Sales(2,3): | |

| Gold production | 193,502 oz |

| Cash operating costs |

$859 /oz produced |

| AISC |

$1,143 /oz sold |

| Gold revenue | $373 M (approx.) |

| Gold sales | 190,800 oz |

| Average realized gold price | $1,954 /oz |

| FY 2024 Guidance Production, Costs(2,3): | |

| Gold production | 170 Koz - 190 Koz |

| Cash operating costs | $945 - $1,005 /oz |

| AISC | $1,300 - $1,360 /oz |

| 2023 Processing: | |

| Tonnes of ore milled | 8.30 M (approx.) |

| Grade | 0.97 g/t |

| Recovery | 74.5% |

| FY 2024 Guidance Processing: | |

| Tonnes of ore milled (budget) | 7.9 M |

| Grade (budget) | 0.93 g/t |

| Recovery (budget) | 76.0 % |

| General Information: | |

| Location | The Philippines |

| Mine type | Open pit |

| Metals mined | Gold |

| Ownership |

B2Gold holds its interest in the Masbate Gold Project through indirectly owned subsidiaries. The Company has a 40% interest in Filminera Resources Corporation and a 100% interest in Philippine Gold Processing & Refining Corporation. The remaining 60% interest in Filminera is held by a Philippines-registered company, Zoom Mineral Holdings Inc. |

| Processing plant | Conventional carbon-in-leach type facility |

| Power | Heavy fuel oil- and diesel-fueled power plant |

| Total number of employees | 978 |

| National workforce | 99.1% |

| Mineral Reserve & Resource Estimates (Contained Gold) – 100% Project Basis: | |

| Indicated Mineral Resources(4) | 2.87 Moz |

| Inferred Mineral Resources(4) | 0.53 Moz |

| Probable Mineral Reserves(4) | 1.61 Moz |

| 2024 Exploration Budget | |

| The Philippines (Masbate) | $6 M |

Supporting Documents:

For the latest details and news releases pertaining to the Masbate Mine:

- Click here for B2Gold's Q4 and Full Year 2023 Earnings (dated February 21, 2024)

For a more detailed overview of the Masbate Mine, please refer to the following most recent company documents:

- Click here for B2Gold’s 2024 Annual Information Form (“AIF”) (dated March 14, 2024)

- Click here for B2Gold's Q4 and Full Year 2023 Management Discussion & Analysis ("MD&A") (dated December 31, 2023)

- Click here for B2Gold's Q4 and Full Year 2023 Financial Statements (dated December 31, 2023)

Mineral Resource & Mineral Reserve Estimates:

Masbate Indicated Mineral Resources Statement:

| Area | 100% Project Basis | ||

| Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

|

| North | 14,090 | 0.84 | 380 |

| South | 58,270 | 0.95 | 1,770 |

| Stockpiles | 37,270 | 0.60 | 710 |

| Total Indicated Mineral Resources | 109,630 | 0.81 | 2,870 |

Masbate Inferred Mineral Resources Statement:

| Area | 100% Project Basis | ||

| Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

|

| North | 5,480 | 0.82 | 150 |

| South | 12,860 | 0.92 | 380 |

| Total Inferred Mineral Resources | 18,340 | 0.89 | 530 |

Masbate Probable Mineral Reserves Statement:

| Area | 100% Project Basis | ||

| Tonnes (x 1,000) |

Gold Grade (g/t Au) |

Contained Gold Ounces (x 1,000) |

|

| North | 4,910 | 0.80 | 130 |

| South | 23,620 | 1.01 | 770 |

| Stockpiles | 37,270 | 0.60 | 710 |

| Total Probable Mineral Reserves | 65,800 | 0.76 | 1,610 |

For more information, click here for B2Gold's 2024 Annual Information Form (pages 49-60).